Monday, July 13 Austin Metro Area Real Estate Update

487 new homes emerged on the market in the past 7 days. 19.9% increase from last week.

652 homes went under contract in the past 7 days. 14.2% increase from last week.

431 homes sold and closed in the past 7 days. 11.1% decrease from last week.

87 homes withdrawn or temporarily taken off the market. 14.8% increase from last week.

Austin Metro Area Market Overview

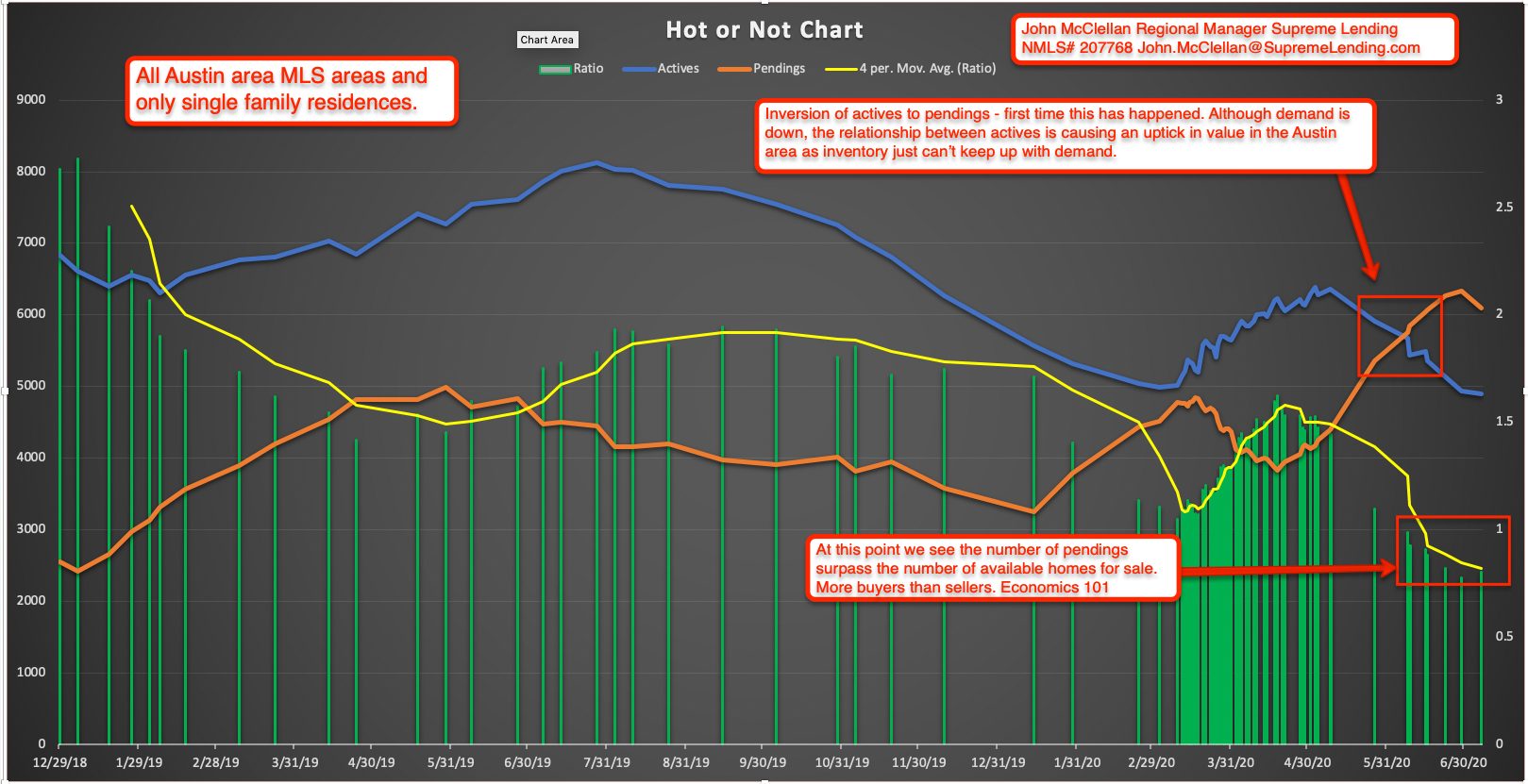

Austin’s critically low housing inventory is creating an unprecedented summer 2020 market frenzy. Regional Manager John McClellan of Supreme Lending put together a graph that pretty much sums up our summer real estate scene. For the first time our pending sales are outpacing new active sales in the Austin metro area.

I’ve been getting a lot of calls and messages lately about our unusual 2020 real estate market. From national news stories about the economy to local media sharing dramatic price increases I want to help our community understand the local scene. If you’ll allow the ex-school teacher a moment I’d like to go back and review how we got here.

Austin Real Estate Housing Scene 2008 to present:

Austin was one of the first large metros to recover from the 2008 mortgage crisis. As we emerged from the crisis, we gained national attention, which in turn attracted more businesses, entrepreneurs, investors and residents to our city. This kicked off a large movement of new homeowners to not only the Austin metro but Texas. This influx of new residents has continued to grow since 2008 and at its peak had 160+ residents moving to Austin A DAY. Due to the mortgage crisis, despite this continual influx of new residents, building of new homes and communities had not fully recovered and was not experiencing the same pace of economic recovery as other sectors of business. This combined with established zoning and development restrictions within Austin has kept the pace of new residential development sluggish while our population has exponentially grown over the past 11 years.

So, to put it in perspective, since 2008 we have had an excess of 590,000 more residents in need of housing while having 38.7% less available homes. So that is 590,696 more people competing for homes with nearly 40% less inventory.

NOW, let’s add into this equation a tech sector that has brought many higher paying jobs into the area. These new residents are making high salaries and have the ability, either from their income OR greater cash assets moving from more expensive metros, to offer 10-20% above ask price for homes as well as the ability to pay cash or cash above appraisal.

So the population is outgrowing the available housing, with all of the above factors still in play, AND then the pandemic hits. At a time of already critically low inventory a new agitator enters the scene…..HISTORICALLY LOW INTEREST RATES. Now we have home buyers at every price point who want to take advantage of this great opportunity. These buyers are out along with the essential home buyers and as a result, we now have a saturated market with multiple offers, full cash or cash over appraisal agreements, and unprecedented low inventory rates. (See again the graph above.)

Some things to consider if you must enter the real estate scene in 2020-2021

- The lending scene has changed dramatically because of Covid-19 so it is more important than ever to work with a local lender and experienced real estate agent that knows how to navigate the obstacles of not only financing but safe home showing practices, industry negotiations during covid, and successful multiple offer strategies.

- I want to encourage people to stay tuned-in to your local real estate market. It’s good to understand what is happening at the national level, but real estate is local, and even within Austin home values can vary dramatically.

- Reach out with questions. As you have seen I am tracking the scene week by week and interpreting the story that I am seeing in the numbers. But this can be overwhelming and as a long time teacher I will tell you there are no stupid questions and nothing is more empowering than gathering all of the information, facts, and knowledge before you make an important decision. So give me a call or email me.

Austin is in a unique position to navigate through this difficult time but we are going to need to find creative solutions to develop more diverse and affordable housing so every Central Texas has an opportunity for home ownership. I’ll look forward to sharing the discoveries I learn from experts exploring the issues.

Reminder of the Metro Area Mask Regulations

Executive orders by the Governor’s office last week placed new limitations on some businesses with direct links to infectious spread. In addition, most Austin metro area cities have now issued ordinances requiring face coverings in business establishments. These steps will all help our businesses and communities stay safe and continue to limit the negative effects of the spread of COVID-19.

Interest Rates & Loan Qualification Updates

Interest rates saw a slight increase last week. Right now you can get 2.875% for a 30 year conventional loan and 2.62% for a 15 year Conventional Loan. Refinance rates are a little bit higher now at 3.125%. If you are looking at refinancing your existing home mortgage be sure to shop around because some banks and lenders are raising rates to discourage new refinances.

Our lenders are still communicating that they expect to see these rates go down this year so it is best to keep an eye on things if you have plans to purchase before 2021. Mortgage qualification rules have changed throughout this pandemic with new Fannie Mae credit score, employment, self-employed and income review regulations. A consultation with one of our local lenders can help you identify how to navigate new financial options for a home purchase so you can plan accordingly.

As always our preferred lenders are available to discuss changes in the mortgage scene and answer your questions.

Agent Jill Summer Projects Journal

I finally did it. I have been dreaming for almost two years about buying one of these and last week I did it. Nope, it’s not a boat or a car or a backyard entertainment center. During the hustle and bustle of pre-covid life I often found myself daydreaming about finding an activity that could bring more simplicity and quiet time into my world. And like a proper girl of the 80’s I often imagined calmly clipping a bonsai tree in my backyard oasis like Mr Miyagi from the 80’s movie Karate Kid. Yeah I know, not what most people daydream about but it just emerged one day in one of my journal entries about things I wanted for my future. I’m trying not to think too much about “why a bonsai” and just let the lessons emerge from the daydream itself. So after years of dreaming I brought home my very own variegated snow white rose serissa bonsai tree. As soon as I got home I placed her right outside my window where I sit and mediate each morning. Then I immediately sat and read the instructions about how to care for my new bonsai. It was at this point that I almost had a panic attack. I sometimes let my daydreaming get ahead of my research tendencies and this was one of those occasions. My daydreaming of calmly clipping a bonsai in my back porch did not include any of the high maintenance instructions that were now in front of me. I felt like a person who brought home a border collie because they imagined all of the fun tricks they could do with these smart dogs but NEVER imagined the other half of the story of owning, managing, and teaching a high energy high maintenance dog.

I finally did it. I have been dreaming for almost two years about buying one of these and last week I did it. Nope, it’s not a boat or a car or a backyard entertainment center. During the hustle and bustle of pre-covid life I often found myself daydreaming about finding an activity that could bring more simplicity and quiet time into my world. And like a proper girl of the 80’s I often imagined calmly clipping a bonsai tree in my backyard oasis like Mr Miyagi from the 80’s movie Karate Kid. Yeah I know, not what most people daydream about but it just emerged one day in one of my journal entries about things I wanted for my future. I’m trying not to think too much about “why a bonsai” and just let the lessons emerge from the daydream itself. So after years of dreaming I brought home my very own variegated snow white rose serissa bonsai tree. As soon as I got home I placed her right outside my window where I sit and mediate each morning. Then I immediately sat and read the instructions about how to care for my new bonsai. It was at this point that I almost had a panic attack. I sometimes let my daydreaming get ahead of my research tendencies and this was one of those occasions. My daydreaming of calmly clipping a bonsai in my back porch did not include any of the high maintenance instructions that were now in front of me. I felt like a person who brought home a border collie because they imagined all of the fun tricks they could do with these smart dogs but NEVER imagined the other half of the story of owning, managing, and teaching a high energy high maintenance dog.

Well here I am. 6 days into owning my new bonsai tree. I am tending to her every day. I’m feeding her, making sure she doesn’t get too much sun and for right now I am just watching her and getting to know her. Ahhhh.