Monday, March 16th – Austin/Central Texas Real Estate Update

Inventory:

Interest Rates:

IMPORTANT SERVICE ANNOUNCEMENT! The Federal Reserve lowered the Fed Fund Rate to ZERO today and will spend $800 Billion in funding to keep rates lower. This does not mean mortgage rates will fall 1% tomorrow.

It is a common belief that when the Fed drops the Fed Fund Rate, mortgage rates also fall. That is not the case. The Fed directly impacts short terms rates. Just a few weeks ago, the Fed dropped the Fed Fund rate .25% and this past week, we saw rates increase over .75% in rate in one week. It was one of the quickest increase of rates in a 5 day period. There are many other factors that go into mortgage rates that I will share in another post.

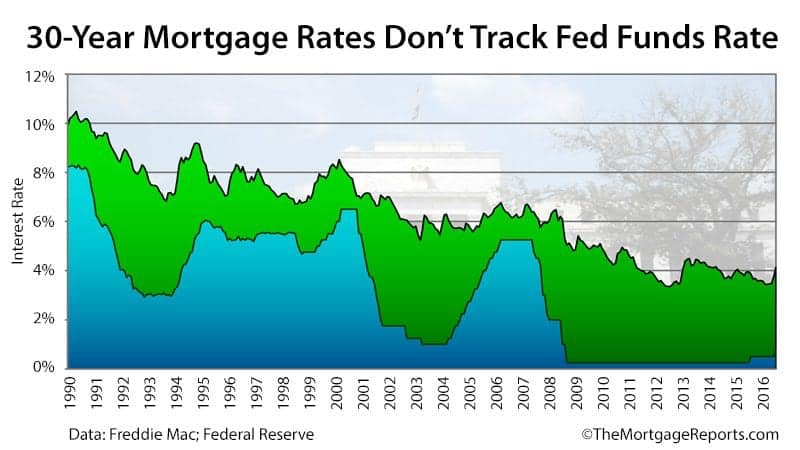

Check out the chart below that tracked 20+ years of the 30yr fixed rate vs. the Fed Funds Rate. The rates have differed by as much as .5% to 5.25% in rate and were not directly impacted by changes.

The $800 Billion in Funding is the thing to watch as they are spending $200 Billion to directly buy mortgage backed securities to keep rates low. This does not mean rates will drop to 2% tomorrow. Trust me, I wish it would! There is a huge demand versus capacity issue with banks and mortgage lenders. $11 trillion of loans need to refinance, but the industry at max capacity can only service $2 trillion.

Overview:

NOTE:

* Feel free to reach out if you need guidance or recommendation for virtual office or education solutions. Our team has extensive experience using online tools and systems that may be of assistance to you during this unique time of adjustment, from homeschooling to home officing.

* If school or community closures have you concerned about a child or senior not being able to eat, please let me know. I will do what I can to help. A cooked meal, a box of cereal, a gallon of milk, bread, peanut butter and jelly…whatever it may add up to, I will help as much as possible!

Do not be ashamed; we all need help at times.

IT TAKES A VILLAGE!