2023 Austin Economic Forecast Highlights

Every year in the early part of the first quarter our team takes a deep dive into understanding local and state market conditions and trends so that we can serve our clients for the year ahead. 2023 has us smack in the trenches of a wildly shifting market that requires a new lens and new conversations about the outlook of real estate. While there can be national housing data and trends there is no national real estate market. Real estate is, and has always been, a local game and providing consumer education of this scene is our #1 job. We’ve had the honor of listening to and studying with some of the best expert economists and demographers as we kick off this year and we want to arm our Holistic clients with the most up to date news and perspective so you can launch your investment daydreams from a place of understanding. Knowledge is power!

As we roll out of the pandemic into this new phase of recovery we are more aware than ever of the growing need for quality sources of information. Our monthly news letter will always include local market perspectives in digestible narratives. Because, ultimately, narratives are what structure our daily decision making.

2023 ECONOMIC HIGHLIGHTS AND SCENE

1. Austin, in recent years, has been the envy of the world.

2. Austin has been, and will continue to be, an economic outlier.

3. “IF” there is a recession Texas will fare better

4. Local Austin experts are optimistic about Austin’s economy.

5. The role of immigration & housing. Our nation is dying for workers.

6. Affordability & housing diversity a top priority in our job story.

7. Awareness that our Austin growth is not booming for everyone.

8. The disproportional decrease of black residents in Austin compared to our other large sister metros. We need to better understand why we are losing black and brown children in our community. And furthermore why black residents don’t find Austin top of their list for relocation consideration.

9. Our biggest economic threat rights now are the efforts the feds are making in re-balancing interest rates. A local economist feels the feds have got it wrong.

10. January 2023 median home prices dropped 6.3% to $450,000 the largest price drop since 2011

11. Increasing affordability trends amongst our renters that is more in line with Silicon Valley and employees commuting 2 hours. Rent is 40% cheaper in San Antonio then Austin. Greater effort to keep attention focused on the divergence of rent price.

12. Our economic problem at the core is not affordability but city regulation and we must work to solve this.

13. 1 million of our jobs are within city limits and we need to find transportation solutions that ensure all of our workers can connect to their places of employment quickly.

A FEW NOTES ABOUT NATIONAL HOUSING DATA – (not market conditions)

14. Nationally we have a 5.5 million gap in housing availability which will require a once in a generation response to increase housing supply.

15. National Data indicates there will be a housing shortage based on the influx of the millennial population into the housing market.

If there were ever two slides that capture the national real estate story it is the two below.

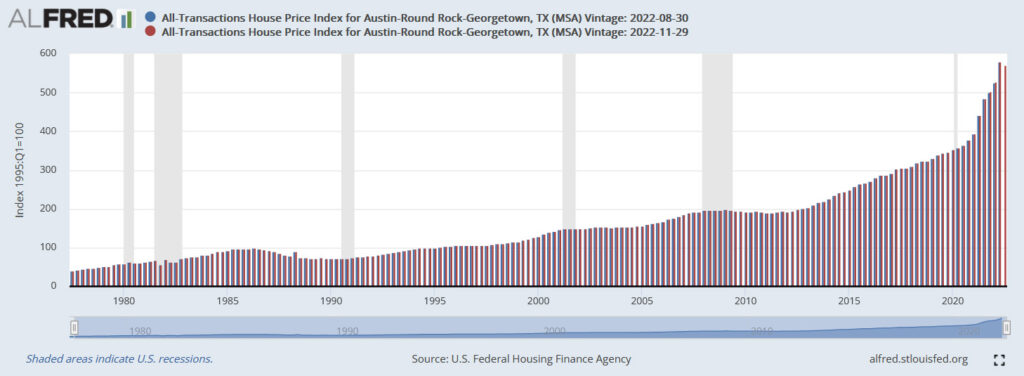

Raising homes prices vs. Declining Housing Supply. Slide one, in a single image, shows us the historic benefit in investing in real estate. While I hesitate to use the word safe when describing real estate investing when you look at the trends over the past 47 years it’s hard to dispute that the story slants towards safety.

Slide two on the other hand is the image of the slowdown in home building and the availability of homes for our citizens, neighbors, and children. The fact that we are not talking about this more surprises me.

Each one of these highlights could be an exploration all on its own. We look forward to continuing the conversation in our community education series workshops as we provide educational resources to our neighbors and the Central Texas region we love.

Like or follow us on YouTube, Facebook or check out our website to stay tuned to our local market scoop.